Increasing efficiency, compliance and decision performance through financial digital transformation

This case study charts the successful implementation of the Investment Gateway Application by the Oakland Group in collaboration with the Network Rail Finance team.

The project aimed to transform the Investment Authority process, ensuring consistency, compliance, and efficient decision-making across diverse railway projects.

Oakland replaced the old Excel system with a modern web application, resulting in more accurate data, better realtime collaboration, and improved efficiency, reporting, and compliance.

The application’s success has led to growing interest from other departments to integrate their processes into the platform, extending a range of benefits across the organisation.

Network Rail: A Legacy of Innovation

Network Rail has been pivotal in maintaining and enhancing the national railway network since its inception in 2002. With a history that dates back to the early 19th century, Network Rail boasts a legacy of innovation, safety, and commitment to passenger and freight transportation.

The Investment Authority Process

At the core of Network Rail’s main operation is the Investment Authority process, which ensures consistency, adherence to regulations, and careful financial management of its railway projects.

The process involves project sponsors submitting detailed programme/project information in an Investment Paper that covers financial viability, scheduling, risk assessment, and project volumes.

The original process was dependant on manual data entry via Excel, which caused problems with efficiency, accuracy, and speedy decision-making.

The Need for Modernisation

The Excel-based Investment Paper submissions posed serious challenges:

- Error-prone data entry: Resulting in potentially inefficient decision-making and resource allocation

- Reduced collaboration: The lack of a central platform caused longer stakeholder review cycles, compounding the resourcing challenge

- Inconsistent approaches: The Excel template was often populated in different ways, making reviewing multiple Investment Papers sometimes more difficult.

With operational expansion a priority, it was clear that digital transformation in the form of a modern and robust solution was needed.

Drawing on Oakland’s decades of process, data, software and integration expertise, the Network Rail Finance team selected Oakland to design and deliver a cutting-edge web-based application.

What were the project goals?

It was clear from early discussions that the main objectives should focus on speed, insight and ease of use while maintaining stringent controls.

The goals can be summarised as:

- Create an easy-to-use web app to replace the Excel system

- Add system controls for consistent policy adoption and compliance

- Make the submission process easy for sponsors to share detailed information

- Create an effective workflow to review and approve Investment Papers

- Develop a data model for flexible reporting to help users make informed decisions

What was the project scope?

When carrying out large projects, it’s important to know how new solutions will work with existing infrastructure, operations, policies and security.

Oakland recognised that the new application sat within an operations ecosystem so adjusted the scope accordingly:

- Creating a user-friendly web app, focusing on ease of use, scalability and security

- Working with Group Finance to integrate data smoothly and keep it consistent

- Connecting the app with project data for better control and compliance

- Thorough testing to make sure the app is accurate, reliable, and strong

- Setting up a secure system for authorised user and admin access

How did we architect the Investment Gateway Application?

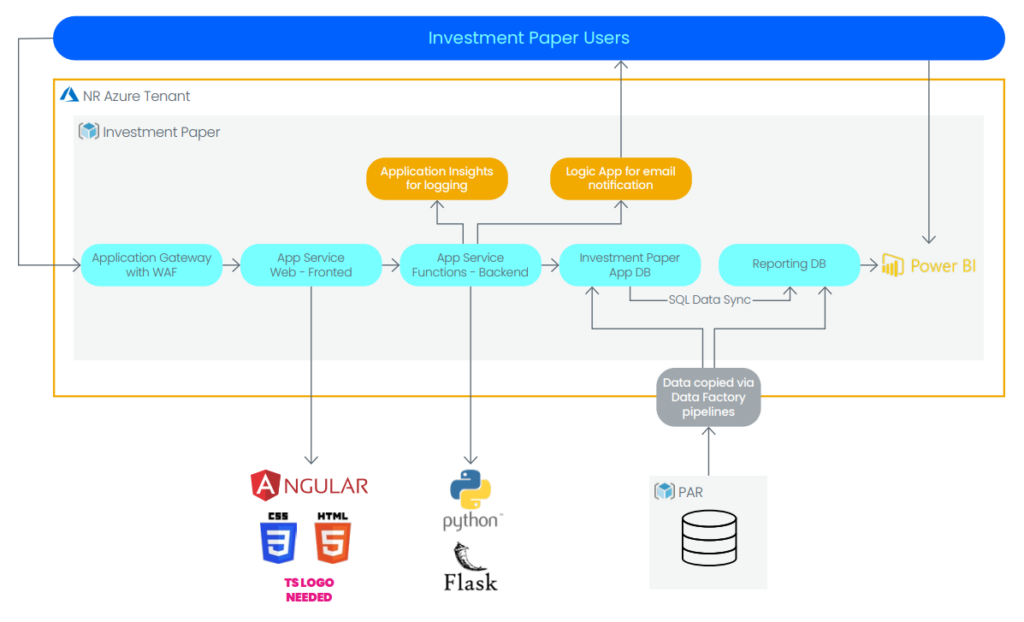

The Investment Gateway became a fully integrated solution that combines a web app and Power BI dashboard:

Here are some of the key advantages of the various architectural components:

Great User Experience

The web app has a user-friendly front-end made with Angular and TypeScript, hosted on Azure App Service. The back-end, built with Python Flask, is deployed as an Azure Function App for scalability and cost savings.

Robust Security

User login is securely handled with Azure Active Directory, ensuring safe access and easy connection with other Azure services for a scalable and efficient system. A web application firewall adds further protection against potential networking attacks.

Effective Storage & Alerts

The app uses Azure Logic App for sending emails and alerts automatically, and stores all investment data securely in an Azure SQL Database for reliability, with maximum integration potential.

Rapid Insights

Power BI sources its data from a reporting database, which is a copy of the application database in Azure SQL. This data is duplicated using Azure SQL Data Sync every 10 minutes to minimise load on the upstream investment application database.

What was our thought process behind the technology options?

The technology for the Investment Gateway App was selected to meet the app’s requirements, scalability potential and secure data handling. Importantly, we also wanted to create a solution that could be managed with existing skills within Network Rail.

For a more technical deep-dive, the engineering and architecture team share more insights below:

Angular and TypeScript

(Front-end)

Angular is a popular and robust frontend framework maintained by Google. It offers powerful features for building dynamic and responsive user interfaces.

The combination of Angular and TypeScript enables the development of scalable, maintainable, and highperformance front-end applications.

Python Flask

(Back-end)

Python Flask is a lightweight and flexible microweb framework. It is ideal for building RESTful APIs, making it an excellent choice for the backend component of the Investment Gateway

Azure Function App

(Back-end)

Azure Function App offers a serverless computing environment, eliminating the need to manage infrastructure and providing automatic scaling based on demand.

This choice ensures cost-effectiveness, as the Investment Gateway App only consumes resources when incoming requests occur.

Azure App Service

(Front-end)

Azure App Service provides a managed platform for hosting web applications, reducing the burden of managing servers and infrastructure.

The platform offers scalability and automatic load balancing, ensuring optimal performance even during traffic spikes.

Azure Logic App

(Email Logic)

Azure Logic App is a powerful integration service that simplifies building workflows and automating tasks across different services.

Azure SQL Database

(Data Storage)

Azure SQL Database is a fully managed cloud-based relational database service, offering high availability, data redundancy, and automatic backups.

It ensures secure and reliable storage of investment data.

Azure Active Directory

(Authentication)

Azure Active Directory provides robust identity and access management capabilities, including Single Sign-On (SSO) functionality.

Integrating with Azure AD simplifies user authentication and enhances security by allowing users to log in using their existing Azure AD credentials.

Scalability and Performance:

Cloud-based services and serverless architectures (Azure Function App) can scale resources on demand, ensuring optimal performance in peak times.

Security and Compliance:

The use of Azure services and Azure Active Directory ensures a high level of security and compliance with industry standards and regulations, safeguarding sensitive financial data.

Microservices Architecture:

The application uses a microservices architecture, allowing separate development and deployment of components for better modularity, maintenance, and scalability

Future-proof and adaptable

The web app and Power BI dashboard can be easily tailored to fit changing client needs, including updates to investment forms, algorithms, calculations, and approval procedures.

Ultimately, the technology for the Investment Gateway was chosen to be scalable, secure, and high-performing, meeting project needs whilst offering a great user experience for stakeholders.

How was the project delivered?

The Investment Gateway Application’s successful delivery resulted from a collaborative effort between the Network Rail Finance team and the Oakland Group.

Agile Planning

The project followed a main delivery plan but was carried out using an Agile method, where we:

Planned in 2-week sprints with specific tasks that followed the overall plan

Finished each cycle with a demonstration to show the work completed

Regularly reviewed progress to learn and identify areas to improve

We were sure to follow the necessary steps required as part of Network Rail IT governance processes. This included creating a number of design documents to outline the approach and rationale and following a rigorous testing methodology to ensure what was developed was undertaken in an approved, robust manner. Most of these design decisions were documented in the Detailed Solution Document (DSD) for approval throughout major project stages.

We developed the solution iteratively and to an evolving plan, notifying Network Rail and discussing any changes throughout the 2-week sprints.

Testing and Quality Assurance

Testing was a major part of the project and we adhered to Network Rail’s procedures for each testing phase, including:

- System Testing

- System Integration

- User Acceptance Testing

- Operational Acceptance

In addition, our team ensured that the following testing activities were delivered:

- Approved test plan, including scenarios for each testing stage

- Approved test completion report for each testing stage

- All critical and high priority defects closed

The benefits of the Investment Gateway Application

The successful implementation of the Investment Gateway Application has created a number of benefits for Network Rail:

Streamlined Process

By replacing manual data entry with automation, the application reduces administrative burden and accelerates the submission and review process.

Improved Compliance

The application’s system controls minimise the risk of non-compliance with policies and regulations, ensuring greater financial responsibility.

Centralised Data

The application is a centralised repository for all Investment Papers, facilitating efficient data access, retrieval, and auditability.

Enhanced Reporting

The new data model gives users comprehensive, real-time reporting for data-driven insights and strategic decision making.

Improved Data Accuracy

Data validation mechanisms reduce the risk of errors and inconsistencies, ensuring data integrity and confident decision-making.

Real-time Collaboration

Stakeholders collaborate seamlessly within the application, leading to faster reviews and approvals, expediting project progress.

Greater Transparency

Enhanced collaboration and visibility allowed stakeholders to better understand the status of Investment Papers, leading to greater accountability and efficiency.

Summary

The Investment Gateway Application, a collaboration between Network Rail Finance and Oakland, has significantly improved the Investment Authority process.

It’s helped the business transition from Excel to a web-based app that brought clear advantages, giving users precise data, smoother workflows, and instant reporting.

What is particularly exciting about delivering this application has been the growing success and interest from other departments within Network Rail, demonstrating its potential as a scalable and adaptable solution for the entire organisation. Developing an approved, productionised application in line with Network Rail’s IT governance processes supported adoption into the business.

Integrating broader processes and data into the app will create a unified platform for managing railway projects, enhancing collaboration and efficiency across the organisation.

With continued teamwork between Network Rail Finance and Oakland, Network Rail can propel itself towards a more digitised, efficient, and innovative future.